Bankers Trust Cedar Rapids

Committed to the Cedar Rapids community since 2002, Bankers Trust proudly serves the commercial and personal banking, lending and wealth management needs around the Corridor and Eastern Iowa. Get to know our services and solutions below and stop by or call one of our two Cedar Rapids locations for more information.

Bankers Trust is proud to live, work and serve in Cedar Rapids, and we’re thrilled to be celebrating 20 years of trust in this community.

Experience the Bankers Trust Difference with a Bankers Trust Checking Account

Earn a $250 bonus* from a bank that has been earning trust for more than 100 years.

Choose from two personal checking accounts designed to help you manage your money, your way. Whether you’re looking for an account with a high monthly interest rate or one that keeps up with your direct and mobile deposits, Bankers Trust has the right choice for you.

- BreakFree Checking Plus – For anyone who frequently uses their debit card. Start earning the benefits you deserve with this high-interest-earning account.

- Direct Checking Plus – For anyone who relies on the convenience of direct deposits or mobile deposits through mobile banking.

Please note: You must visit the branch to open this account.

View the Supplemental Terms and Conditions for BreakFree Checking Plus and Direct Checking Plus accounts.

| Cedar Rapids Main Office 201 1st Street SE Cedar Rapids, Iowa 52401 319.896.7777 |

Blairs Ferry Branch 400 Blairs Ferry Road NE Cedar Rapids, Iowa 52402 319.221.1230 |

Our 2023 Annual Report is Out Now

As important as what did happen in 2023 is what didn’t. Despite higher interest rates, inflation and bank failures, Bankers Trust remained a haven of stability for the families, businesses and communities we serve. Read more.

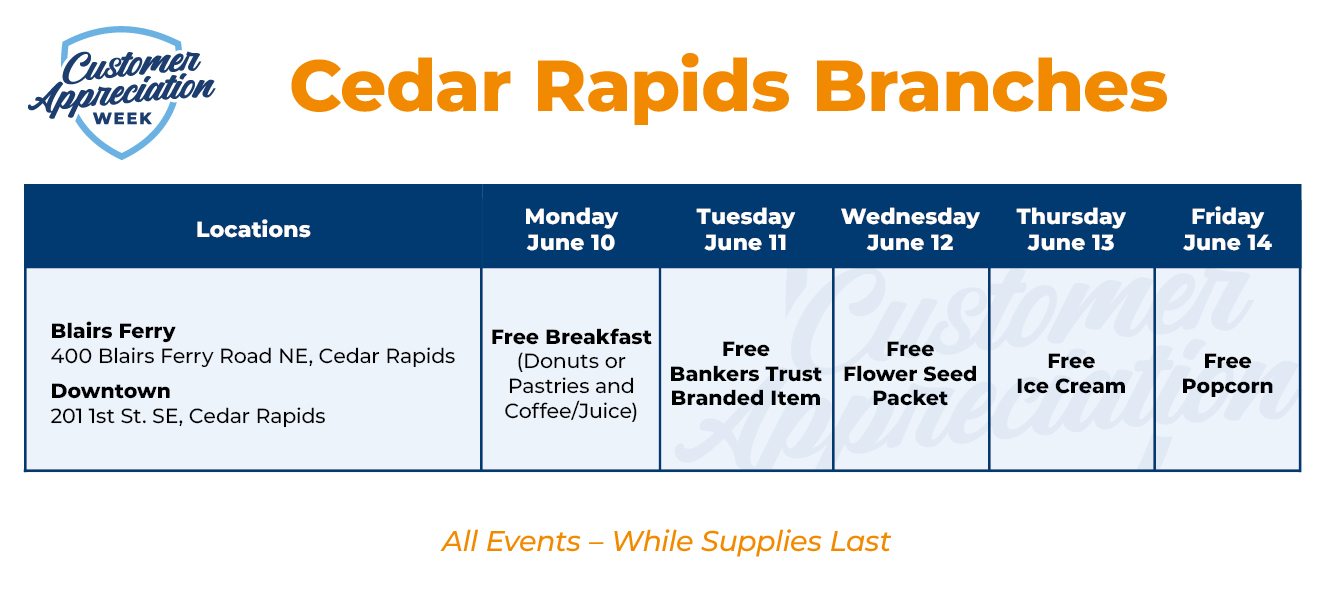

Let’s Celebrate You!

As a community bank, we are proud to live and work in the communities we serve. But we wouldn’t be here without you, our loyal customers. You are the difference, and we want to show our appreciation by celebrating your loyalty!

This summer, our branches will be dedicating an entire week to customer appreciation with a variety of giveaways throughout the week. We hope you’ll join us at our Cedar Rapids branches June 10-14 to take part in the celebration.

Expertise for Your Personal and Commercial Banking and Wealth Management Needs

Personal Banking

We proudly serve the community with a full range of personal banking products and services. With two locations in Cedar Rapids and expanded hours to meet your needs, we make banking convenient. Enjoy all the perks of a national bank, with the benefit of being local, including: 95,000 fee-free ATMs, online and mobile banking and a commitment to security. Learn more about our Personal Banking products and services.

Commercial Banking

Our Commercial Lending and Treasury Management teams help businesses of all sizes throughout Eastern Iowa as they start, grow and transition. With local decision making and flexible solutions, we can be a partner for your business’s success. Learn about our solutions for businesses.

Jack Gonder

Eastern Iowa Market President

Mortgage Loans

Buying a house or refinancing your current mortgage is a big process. The Bankers Trust professionals have the experience to help your mortgage loan process go smoothly. Our mortgage loan originators are highly knowledgeable in their industry and can help you through every step of financing your home. When it comes to choosing a mortgage loan, the “right” loan is different for everybody. Our loan originators will walk you through loan options that fit your particular situation so you can make an informed decision. Contact Cedar Rapids Mortgage Loan Originator, Mike Dupont, here.

Mike Dupont

Mortgage Loan Originator

Wealth Management

Our experienced team of wealth management professionals help families and individuals grow, manage and transfer their wealth. Whether for comprehensive financial planning, trust and fiduciary services or investment management, we can help. Learn more about Bankers Trust Wealth Management.

Note: Non-Deposit Investment Services are not included by FDIC or any government agency and are not bank guaranteed. They are not deposits and may lose value.

*To be eligible for the bonus you must open a BreakFree Checking Plus or Direct Checking Plus account (“Bonus Account”) in person at a branch with a minimum opening deposit of $25. To qualify for the bonus, customers must complete the requirements below through the Bonus Account within 60 days from the date of its opening. Bonus will only be credited if the account is currently in an open status with a positive balance.

- 25 debit transactions. A “debit transaction” for the purpose of this section means a debit to your Bonus Account that originated from an ACH, Bankers Trust bill payment, drafting checks, or use of your debit card as a method of payment or purchase. Qualifying debit card transactions must post and settle during the 60 days from account opening. A “debit transaction” does not include debits to your Bonus Account that originated from ATM withdrawals or other debits to your Bonus Account; and,

- 2 direct (ACH) and/or Mobile deposits of at least $200 each must post and settle during the 60 days from account opening. A “deposit” for the purposes of this section does not include ATM deposit, deposits made in person, account-to-account transfers, or other deposits to your Bonus Account.

Eligibility will be verified 60 days after the Bonus Account’s opening. Bonus will only be credited if the account is currently in an open status with a positive balance. Should you have met all eligibility requirements and are not subject to the limitations and exclusions contained herein, the bonus will be credited to the Bonus Account within 75 days of its opening. Limit one bonus per household. Offer not available to existing Bankers Trust checking customers or those that have had a checking account with Bankers Trust within six months of Bonus Account opening. Employees of Bankers Trust and/or its affiliates are not eligible for bonus.

**20th Anniversary Pick-a-Term CD is not available online and must be purchased in person at either Cedar Rapids branch location. The advertised rate is based on the current interest rate offered plus the rate available to those customers who qualify for the Platinum Level of the Relationship Package. Visit BankersTrust.com for more information on Benefits Banking Relationship Package terms. Limited time offer.

Minimum balance to obtain APY is $1,000.00. Minimum balance for minors to obtain APY is $500.00. Minimum balance for IRAs to obtain APY is $200.00. Minimum balance for Auto-Save IRAs to obtain APY is $50.00. Penalty for early withdrawal. Fees may reduce earnings. The interest rate and APY are effective as of November 4, 2022, and are subject to change without notice. Stated APY based on 12-month term. APY may vary if another term is selected. Available only for customers holding accounts for personal, family or household purposes. Not valid with any other promotional offers. Interest rates will not automatically apply to Certificates of Deposit that are automatically renewing during this promotion.

HSA CD Requirements: 1) You must maintain a Health Advantage account at Bankers Trust in conjunction with the HSA CD. 2) The HSA CD must be funded from the Health Advantage account. 3) If you request HSA CD interest be paid to you (as an alternative to adding the interest back to the HSA CD), it must be transferred to your Health Advantage account. 4) If you redeem (cash out) the HSA CD, the money must be transferred back to your Health Advantage account. 5) The Bankers Trust Wellness Option – which permits penalty-free early withdrawals from CDs if the funds are used for medical expenses – does not apply to the HSA CD. Early withdrawals of principal made for any reason, including medical expenses, are subject to penalty.